Platinum Group Metals (PGMs)

Have 2024 Market Prices for Platinum, Palladium, and Rhodium Gone Back to Normal?

Whether you’re a scrap metal or automotive recycler or a converter buyer, you’re watching the Platinum Group Metal (PGM) market closely. Especially the prices for platinum, palladium, and rhodium—three precious metals found inside catalytic converters. And although market values have decreased since early 2021, experts say the metals have just returned to normal.

But what is a normal price for PGMs? And what does it mean for your converter and scrap car recycling business that market prices are “normal” again? If you’re ready to get informed, keep reading. We’re giving you all the answers on market values and peeling back the layers of confusion on current trends.

Pre-Pandemic vs. Pandemic Market Trends: A Drastic Increase

If you were recycling converters before and during the pandemic, you experienced firsthand the increase in market prices for PGMs. It was almost an overnight success. Prices soared to never-before-seen values.

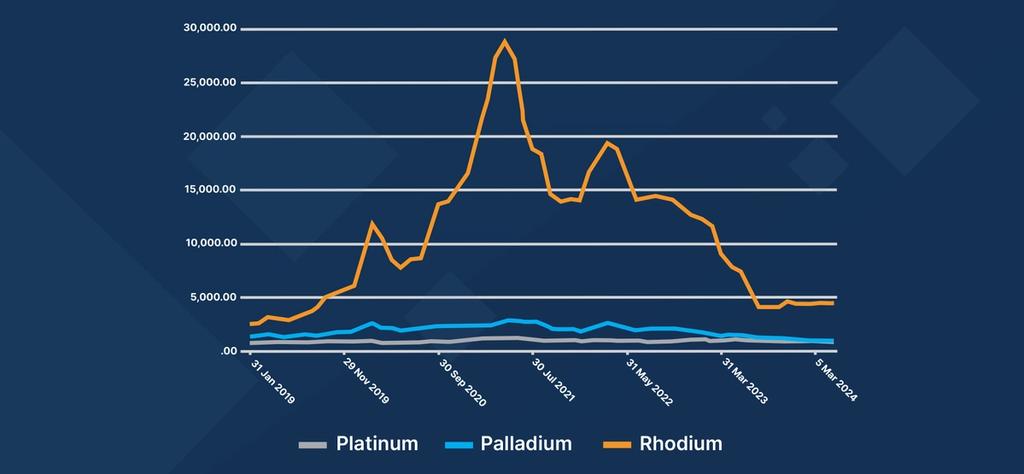

Rhodium reached a peak of $28,743.86 in April 2021, with platinum hitting highs of $1213.38 in April 2021 and $1129.59 in late June. Palladium followed with peak prices of $2531.95 in February 2020, $2786.71 in April 2021, and $2605.61 in March 2022.

But this increase didn’t happen in a vacuum. Let’s explore how the unique worldwide conditions created by the pandemic drove market prices skyward.

Why Did PGM Market Prices Increase Between 2020-2021?

In early 2020, worldwide restrictions and lockdowns at major automotive plants caused a major decrease in PGM demand. Along with this, many PGM recycling facilities and mining operations experienced temporary closures, which decreased the available supply.

Vehicle manufacturing and sales dropped in 2020, with jewelry and industrial demand for PGMs following in the downward trend. These conditions caused damage to the supply and demand dynamic for platinum, palladium, and rhodium.

However, by Q2 of 2020, with all other methods to get PGMs closed or disrupted, sales started rising. Wholesalers and other major buyers took advantage of these low market prices to buy.

By 2021, South African mines suffered plant outages, constraining primary supply of PGMs even more. Demand, however, decreased due to a combination of semi-conductor chip shortages and decreasing vehicle and jewelry manufacturing sectors.

When primary supply recovered, this created a unique atmosphere on the market. According to Johnson Matthey’s PGM Market Report of May 2022, this mismatched supply and demand, market prices skyrocketed to unusual prices.

And that’s why you saw rhodium hit almost $30,000 for the first time ever. But what happened after 2021, and why did the prices tumble back down?

Post-Pandemic Market Trends: Why Did Prices Drop?

As South African mines returned to full operational capacity and secondary supply methods started back up, the availability of PGMs increased. But demand fell back down as the semi-conductor chip shortage persisted, vehicle manufacturing stalled, and new vehicle sales continued to drop. With barely any demand, the prices for PGMs suffered.

According to Johnson Matthey’s PGM Report of May 2022, this new reality for PGMs knocked market prices off their extraordinary podium.

2024 Market Prices: Going Back to Pre-Pandemic Values

At the end of 2022, prices for all three PGMs started a decreasing trend, making converter and scrap car recyclers wonder why the prices were taking a nosedive. Some experts say that with supply and demand getting back to a normal dynamic (i.e. pre-pandemic), prices returned to their 2019 values.

With automotive production and new vehicle sales resuming, semi-conductor chip shortages ending, and industrial demand returning to normal; prices settled back to their 2019 places.

That’s why platinum returned to values between $953.33 and $915.89 from July 2023 to late March 2024. Palladium traded between $1275.90 and $1030.11 during the same months.

Only rhodium is trending higher than pre-pandemic prices, trading between $4119.05 and $4576.39 from mid 2023 to late March 2024.

What Do Current Market Trends Do for Your Converter Business?

Many scrap metal and automotive recyclers share the same sentiment: hoard your converters until market values trend back to the golden prices of 2021.

But if you’re hoarding your converters right now, waiting for market prices to get back to the values of 2021, you’re leaving money on the table. And you might be waiting for market prices that we won’t see again for decades to come.

Just like you wouldn’t leave money in your mattress anymore, you shouldn’t hoard your converters. Not only are you putting them in danger of theft but you’re also not benefitting from them.

Current market trends are still profitable, just like they were before the pandemic. And if you’re not getting your converters processed, you’re letting valuable material sit there, doing nothing for you and potentially decrease in value.

Get your converters processed so you can maintain a steady cash flow into your business and profit from current market trends. Prices won’t go back to 2021 values any time soon, so instead of waiting and hoarding, letting your business suffer from a lack of extra revenue, start profiting from your converters right now.

For more information, visit PMR’s Resource Center.