Catalytic converter 101

Why are catalytic converters so valuable and why are their precious metals worth more than the rest of the car combined?

In an era where the cost of automobiles is on a steep climb, one question keeps resurfacing: What’s the most expensive part of a car? The answer varies, but for recyclers like yourself, it’s clear. The catalytic converter. It consistently outranks every other component of a vehicle at scrap yards, but why are they so valuable, and why do some converters sell for dramatically more than others?

We partnered with Thubprint, scrap metal expert, to break down what’s inside catalytic converters and which factors determine their true worth. Watch our video below, or keep reading for the full breakdown!

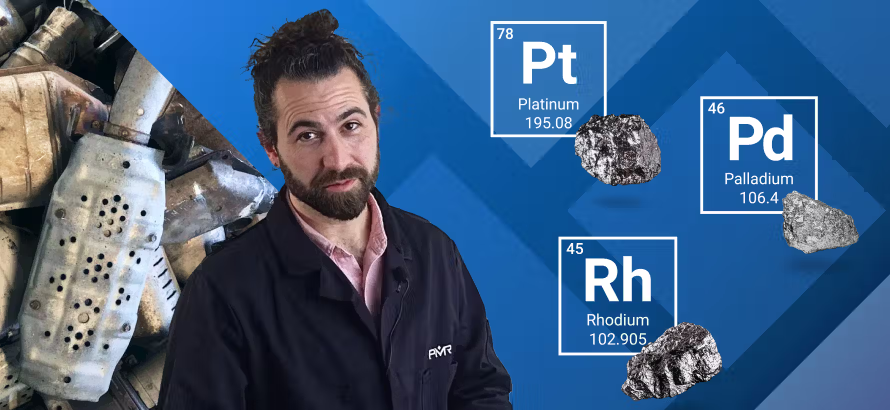

Which precious metals are found in catalytic converters?

Catalytic converters contain three platinum group metals (PGMs): platinum, palladium, and rhodium. These precious metals routinely outperform gold on the PGM market, and automakers rely on them heavily for vehicle exhaust systems.

Why are PGMs used in catalytic converters?

Catalytic converters are essential for meeting modern environmental standards and are required on all passenger vehicles. That’s because the PGMs they contain act as catalysts. Without PGMs, your engine emits nitrogen oxides, carbon monoxide, and hydrocarbons–harmful emissions. Platinum, palladium, and rhodium trigger chemical reactions that transform these pollutants into far less harmful gasses.

Platinum and rhodium break nitrogen oxides apart inside the catalytic converter, releasing nitrogen and oxygen gas. And platinum and palladium oxidize carbon monoxide and hydrocarbons into carbon dioxide and water vapor.

These precious metals are well suited for this job because they’re extremely tough and durable. They resist corrosion, heat, acids, and physical wear and tear, which is ideal for the harsh, high-temperature environment inside a converter.

While some PGMs are used for making jewelry, electronics, and other commonplace items, about 60% of global PGM production goes into catalytic converters.

It's easier to get platinum, palladium, and rhodium from scrap catalytic converters than it is to make new material. That’s because it takes a lot of mined ore to get just a little bit of these precious metals. Rhodium is especially rare and is mainly found as a by-product when mining other metals like platinum, palladium, or nickel.

Why do PGM prices fluctuate so much?

Precious metal recycling requires significant labor, energy, and time. Mines rely on coal-powdered energy and fuel-intensive transportation. Rhodium extraction is especially difficult because mines can recover only tiny quantities at a time.

That means that the market price fluctuations of platinum, palladium, and rhodium found in scrap catalytic converters depend on the supply, demand, price, and trade ecosystems for these precious metals.

For example, various factors can affect the supply and demand of PGMs, like mining output, geopolitics, demand changes in the automotive industry, and more. In 2020, the price of platinum rose from $700 to $1,000 per ounce after the outbreak of the COVID-19 pandemic due to changes in mining supply and automotive demand.

Even though platinum increased, the market price of platinum remained relatively low compared to other PGMs, such as palladium, which is the primary metal used in catalytic converters. Over the course of one year, the price of palladium also surged, rising from $1,000 to $3,000 per ounce.

What makes Rhodium different from other PGMs?

Rhodium has a unique origin story with catalytic converters. The use of rhodium in autocatalysts is a new development. Older converters primarily used platinum, but modern emissions standards drove automakers to integrate more rhodium because of its superior ability to reduce nitrogen oxides.

Today, rhodium is used almost exclusively for catalytic converters which makes it less frequently traded. That explains why its market price is more volatile than other PGMs.

How much is a catalytic converter worth, and why are some nearly worthless?

Several factors influence catalytic converter prices, like the unit type and current valuable metal prices. But the true worth of your scrap catalytic converters depends on how much platinum, palladium, and rhodium remain.

Recyclers will attempt to estimate, but the only way to determine the exact amount of valuable metals left inside a used catalytic converter is through toll refining. Toll refiners have special technology built to extract and measure every ounce of PGMs contained in the ceramic core.

But why are some converter’s market value nothing, even after being toll refined? Let’s go through the different unit types, and why some are worth more than others.

Aftermarket converters vs. OEMs

Aftermarketcatalytic converters typically contain about 10% of the PGM content found in Original Equipment Manufacturer (OEM) material. They serve as low-cost, broad-fit replacements. Because they contain far fewer precious metals, scrap prices for these pieces may be significantly less.

OEMs are built by the same company that manufactured the vehicle. Scrapping these units tends to generate more precious metal content, which is why they sell for more on the market.

What are reject converters?

Reject catalytic converters are converters that have manufacturing defects. For example, if there is an issue with the ceramic brick during the production process, and it gets coated with precious metals, the resulting converter has no value.

These reject converters can be identified by their white or yellow appearance, a sign that they contain no valuable precious metals at all.

Fair warning: Although these converters have no value, some scrap yards may still attempt to sell them. This can be challenging because there are some used catalytic converters that are highly valuable, since they haven’t been in use for 10-15 years, preserving their precious metal coating.

This is why identification and partnering with a processor you trust is crucial.

How the auto-parts industry affects catalytic converter scrap prices?

Scrap prices don’t rely only on metal markets. They are also influenced by the broader auto-parts supply chain. When new catalytic converters become harder to source, either due to factory shutdowns, shipping delays, or raw material shortages, demand increases for used OEM converters.

This indirectly boosts the value of catalytic converter scrap because OEM units contain higher concentrations of PGMs.

In contrast, an aftermarket cat tends to fluctuate far less in value since it carries minimal precious metal to begin with.

Also, when automakers shift designs or introduce new emissions technology, certain converters become more in demand on the recycling side because they contain higher PGM loadings. Scrap yards that understand these industry patterns can time their scrapping strategies more effectively and maximize their returns.

Why is global demand for PGMs rising?

Governments worldwide are tightening emissions, pursuing carbon-neutral targets, and accelerating the shift towards hydrogen-based energy. Meanwhile, global car sales continue to increase.

These trends, among many others, are some of the most important factors that push the demand for platinum, palladium, and rhodium higher, and with it, their prices.

The growing role of scrap yards and why identification matters more than ever

As catalytic converter scrap becomes more valuable, scrap yards have had to adapt quickly. Most yards now rely on stricter procedures, better tracking systems, and stronger relationships with processors.

Since the value of a scrap catalytic converter varies, scrap yards must correctly identify each unit before quoting a price. For example, a converter from a large SUV may contain more PGMs than an aftermarket cat from a hatchback. The scrap prices between the two can differ by hundreds of dollars, especially when metal prices and the current price of PGMs shift rapidly on the market.

This is why serial numbers have become so important in the recycling industry. OEM catalytic converters almost always include a serial number stamped, etched, or engraved on the shell.

These identifying marks help buyers verify whether a converter is OEM, aftermarket, or part of a previous scrapping batch. Because aftermarket converters contain so few precious metals, scrap yards often rely on the serial number to prevent overpaying.

When a converter lacks a serial number entirely, many yards either refuse it or pay significantly less because the risk of misidentification is too high.

Catalytic converter theft and the need for stricter controls

The rise in catalytic converter theft over the past decade directly ties to the increasing value of PGM content. Thieves know that even a single OEM converter can bring in quick cash, particularly when metal prices surge or when the current price of rhodium spikes.

As a result, many scrap yards now require proof of ownership or documentation that verifies how the converter was bought. Some jurisdictions have introduced legal requirements that scrap yards record the seller’s ID, the converter’s serial number, and photos of the converter before completing any purchase.

These steps protect both recyclers and legitimate sellers and help stabilize the catalytic converter scrap market.

Vehicle owners have also started marking or engraving their converters with unique identifiers to make stolen units harder to sell. This helps scrap yards authenticate incoming auto parts and reduces the likelihood of buying stolen material.

The more traceable a converter is, the easier it becomes for processors and scrap yards to maintain transparent, ethical scrapping practices.

Will the transition to electric vehicles hurt the PGM market?

Not anytime soon. Despite the rapid EV growth, conventional gas and diesel-powered vehicles still dominate car sales globally. In some regions, conventional cars remain very common because of weak charging infrastructure, high costs of EVs, and policy-lag. For example, in 2023, EV car sales in the United States represented only 10% of all purchases.

But even with the sale of electric vehicles booming worldwide, the use of PGMs remains critical. The development of hydrogen-powered cars offer a clean fuel alternative that produces only water vapor when burned–but will use platinum as a crucial catalyst. Hybrid vehicles still contain an internal combustion engine, so they are required to have a catalytic converter.

The future of platinum, palladium, and rhodium remains strong. Demand for PGMs is expected to stay robust for years to come, supported by traditional technologies and some new emerging ones.

For more information, book a free consultation or explore additional resources on the PMR blog.